Because almost everything is completed on the web and you don’t have to bother with developing a membership or banking account, online lenders may consider significantly less time for you to approve and fund your smaller personal loan.

Set month-to-month payments. Personal loans are lump-sum loans that are repaid in fastened regular monthly payments in excess of a established timeframe.

Sky-high fees and interest rates: Some loans, like payday loans, come with desire premiums as significant as 400%, which might allow it to be hard to repay that financial debt. Several borrowers end up having to choose out extra loans to repay their unique loan, trapping them inside a cycle of personal debt.

Disorders—The existing point out from the lending climate, trends within the business, and what the loan will probably be used for

Vacation rewards0% APR credit cardsCash again credit cardsBusiness credit cardsAirline credit score cardsHotel credit score cardsStudent credit rating cardsStore charge cards

The word "loan" will probably seek advice from this sort in day-to-day discussion, not the kind in the 2nd or 3rd calculation. Below are backlinks to calculators connected to loans that fall below this class, which can provide additional information or let specific calculations involving Each and every form of loan. As an alternative to applying this Loan Calculator, it could be more valuable to implement any of the next for each certain need to have:

Loans range between $100 around $35,000 APR premiums starting at 5.ninety nine% up to 35.ninety nine% 91-day least repayment plus a seventy two-thirty day period optimum repayment expression for effectively competent people. By clicking "Request Now", I consent to Conditions & Disorders, Privateness Plan, Credit score Authorization, E-Consent, I also give my Specific consent to share my information and facts with up to 5 of FastLoanDirect's Network Companions or approved 3rd get-togethers on their behalf to verify my information also to Get hold of me at the knowledge on file via phone phone calls, textual content messages, and/or e-mail, such as for internet marketing functions, employing an automatic phone dialing method or an artificial or pre-recorded voice whether or not my telephone number is outlined on any Do-Not-Phone (“DNC”) lists. Consent isn't expected to purchase any merchandise or products and services. I realize I may decide out at any time by replying ‘Quit’ to decide out Which my supplier may perhaps cost me for these texts. By clicking "Ask for Now", I consent to Conditions & Conditions, Privateness Plan, Credit score Authorization, E-Consent, I also consent to share my data with up to 5 of FastLoanDirect’s Community Partners or authorized third events on their own behalf to contact me at the knowledge on file.

The lender might want proof of the id, proof of your respective address, financial institution statements, evidence of earnings and employment and They could do a tough pull in your credit rating report. This could lower your credit history score even even more so be conscious of that.

At the time that marketing time period ends, however, you’ll have to pay back fascination within the remaining balance. These promotions can past anywhere from twelve to 21 months. When you’re specified you'll be able to pay off your harmony ahead of the close with the introductory period, these playing cards could be a great solution.

The loan expression also performs a Think about simply how much a loan can cost. A longer loan phrase suggests lower month to month payments, however, you’ll finish up paying additional in desire.

So why can be a credit history rating so imperative that you a lender? Perfectly, your credit rating rating will clearly show your lender if you are a great danger or not. From a credit history report, the lender can inform in case you owe lots of money, when you make your payments on time or not, and In case you have been actively trying to get new credit. Any of such is often purple flags into a lender and can make them think about you a higher credit history hazard.

Should you’re searching for a little loan, especially one particular value a lot less than $1,000, take into account a credit score union personalized loan. These member-owned money institutions can offer far more flexible loan solutions and less charges in comparison with all your classic lender.

Little loans can decreased your credit score, although the effect is often non permanent. When lenders operate difficult-credit rating pulls to approve you for funding, the pull website places a little dent inside your score, even so the outcome typically disappears within just two decades.

Terrible credit rating often stops folks from applying with the loan they want. Some borrowers Assume they may have terrible credit rating, but Never and a few borrowers Assume they have got fantastic credit rating ,but Do not. It really is generally a good idea to Look at your credit rating score prior to deciding to apply for credit history.

Emilio Estevez Then & Now!

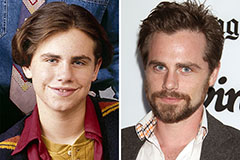

Emilio Estevez Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!